Infrastructure Wars: How Compute Constraints Reshape AI Competition

Episode Summary

Your weekly AI newsletter summary for August 24, 2025

Full Transcript

STRATEGIC PATTERN ANALYSIS

The week of August 18-24 reveals four strategically critical developments that collectively signal a fundamental restructuring of the AI industry's competitive dynamics and value creation models. First: Infrastructure as the Ultimate Moat - Altman's revelation about OpenAI withholding superior models due to compute constraints isn't just about technical limitations. It exposes that we've reached an inflection point where the bottleneck to AI advancement has shifted from research breakthroughs to raw computational capacity.

This transforms AI competition from an R&D contest into a capital infrastructure war. Companies aren't just competing on model quality anymore - they're competing on who can afford to deploy superintelligence at scale. Second: The Commoditization Paradox - The emergence of ultra-cheap Chinese models achieving GPT-4 level performance at 90% cost reduction creates a fascinating strategic paradox.

While this should commoditize AI capabilities, it's simultaneously forcing Western providers to retreat upmarket into premium positioning around security, compliance, and specialized applications. We're witnessing the classic technology adoption curve compressed into months rather than years. Third: Persistent Memory as Strategic Lock-in - GPT-6's memory architecture represents more than a feature upgrade - it's the creation of switching costs that could fundamentally alter enterprise AI procurement.

Once an AI system accumulates months of organizational context and personal preferences, migration becomes existentially risky for businesses. This isn't just technological advancement; it's the creation of the first true AI-native competitive moat. Fourth: Organizational Structure as Competitive Advantage - Meta's radical AI restructure under Alexandr Wang signals that traditional tech company organizational models are inadequate for AI development velocity.

The dissolution of research-focused teams in favor of execution-oriented structures suggests the industry is transitioning from discovery phase to deployment phase.

CONVERGENCE ANALYSIS

Systems Thinking: These developments create a reinforcing cycle that's reshaping the entire AI ecosystem. Infrastructure constraints drive companies toward more efficient deployment models, which accelerates the development of persistent memory systems to maximize user retention. Simultaneously, the commoditization pressure from low-cost alternatives forces organizational restructuring to achieve faster iteration cycles.

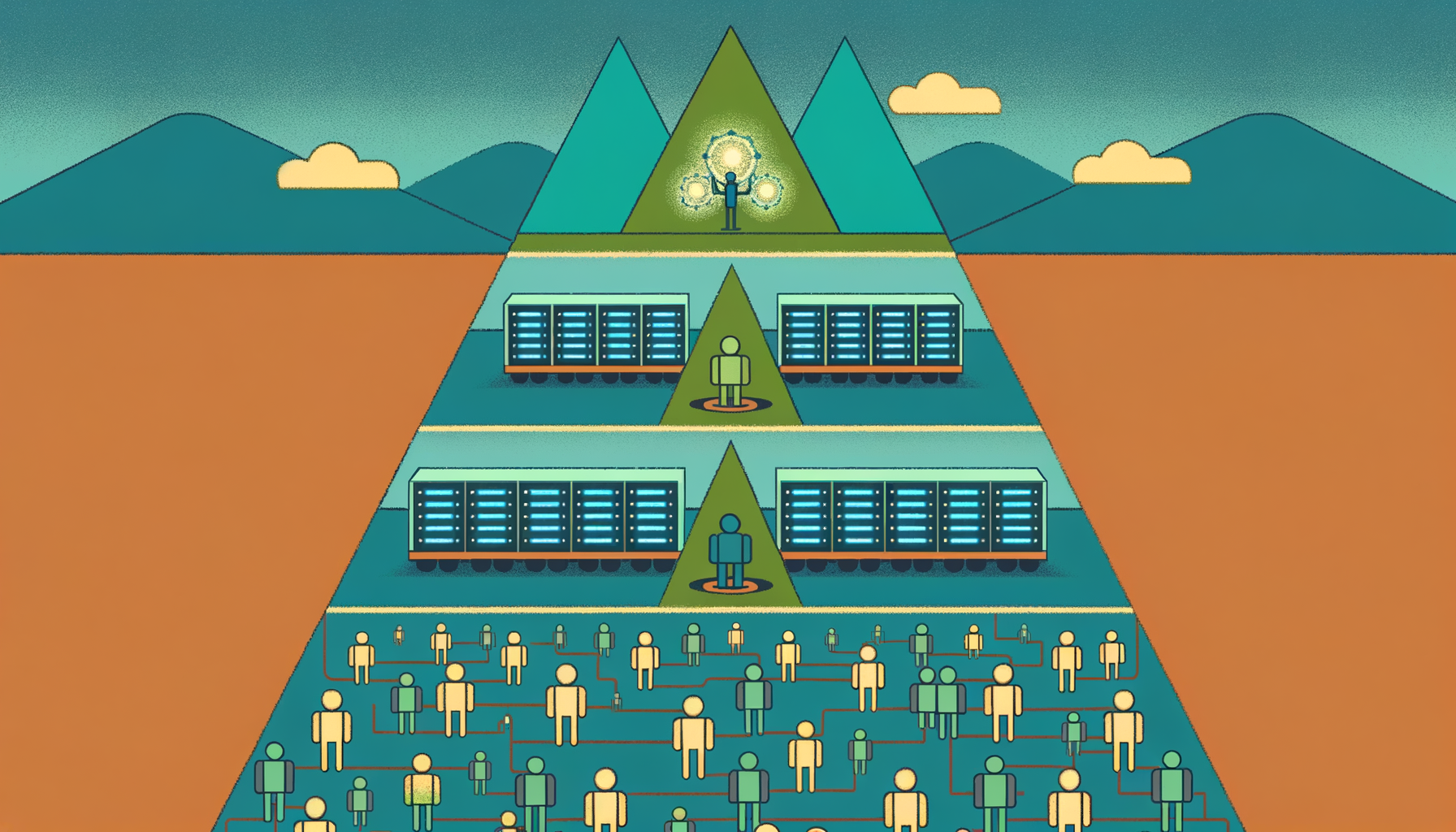

The result is an industry moving toward a barbell distribution - ultra-cheap commodity AI on one end, and deeply integrated, context-aware AI systems on the other, with very little viable middle ground. Competitive Landscape Shifts: The convergence creates three distinct competitive tiers. Infrastructure titans like Microsoft and Google leverage compute capacity to deploy advanced models at scale.

Integration specialists like the repositioned Meta focus on organizational velocity to create differentiated AI experiences. Meanwhile, cost leaders primarily from China compete on efficiency and accessibility. Traditional SaaS companies caught between these tiers face strategic compression - they lack the capital for infrastructure competition, the organizational models for rapid AI iteration, or the cost basis for commodity competition.

Market Evolution: The intersection of these trends creates two emergent market opportunities. First, AI governance and security tooling becomes critical as enterprises navigate between cost-effective foreign models and premium domestic alternatives. Second, AI orchestration platforms that enable model diversity strategies become essential infrastructure, allowing companies to optimize across cost, performance, and security requirements dynamically.

Simultaneously, this convergence threatens the viability of single-model AI service providers who can't compete on infrastructure, cost, or integration depth. Technology Convergence: We're seeing unexpected convergence between consumer AI experiences and enterprise infrastructure requirements. Persistent memory systems developed for personalization become enterprise knowledge management platforms.

On-device AI processing originally designed for smartphone privacy becomes the foundation for edge computing strategies that reduce infrastructure dependencies. Organizational restructuring optimized for AI development velocity becomes a template for how traditional companies must reorganize around AI-first product development.

Scenario One: Infrastructure Consolidation - Compute constraints force industry consolidation around 3-4 infrastructure providers who control access to advanced AI capabilities.

This creates a new category of "AI cloud providers" distinct from traditional cloud services, with pricing power that fundamentally alters software economics across all industries.

Scenario Two: AI Governance Regulation - Security concerns about foreign AI models trigger regulatory frameworks that create artificial barriers between cost and compliance.

This bifurcates the market into regulated and unregulated AI services, creating premium pricing opportunities for compliant providers while pushing non-compliant alternatives underground.

Scenario Three: Memory-Dependent Markets - Persistent AI systems become so central to business operations that switching costs approach those of ERP replacements.

This creates winner-take-all dynamics in AI adoption, where early choices become permanent competitive advantages or disadvantages based on the accumulation of organizational AI knowledge over time. The strategic imperative is clear: companies must simultaneously prepare for commodity AI pricing while building defensible positions around data integration, regulatory compliance, or organizational AI adoption velocity. The middle ground is disappearing rapidly.

Never Miss an Episode

Subscribe on your favorite podcast platform to get daily AI news and weekly strategic analysis.