AI App Market Stabilizes: Google Surges, Vibe Coding Explodes

Episode Summary

Your daily AI newsletter summary for August 29, 2025

Full Transcript

TOP NEWS HEADLINES

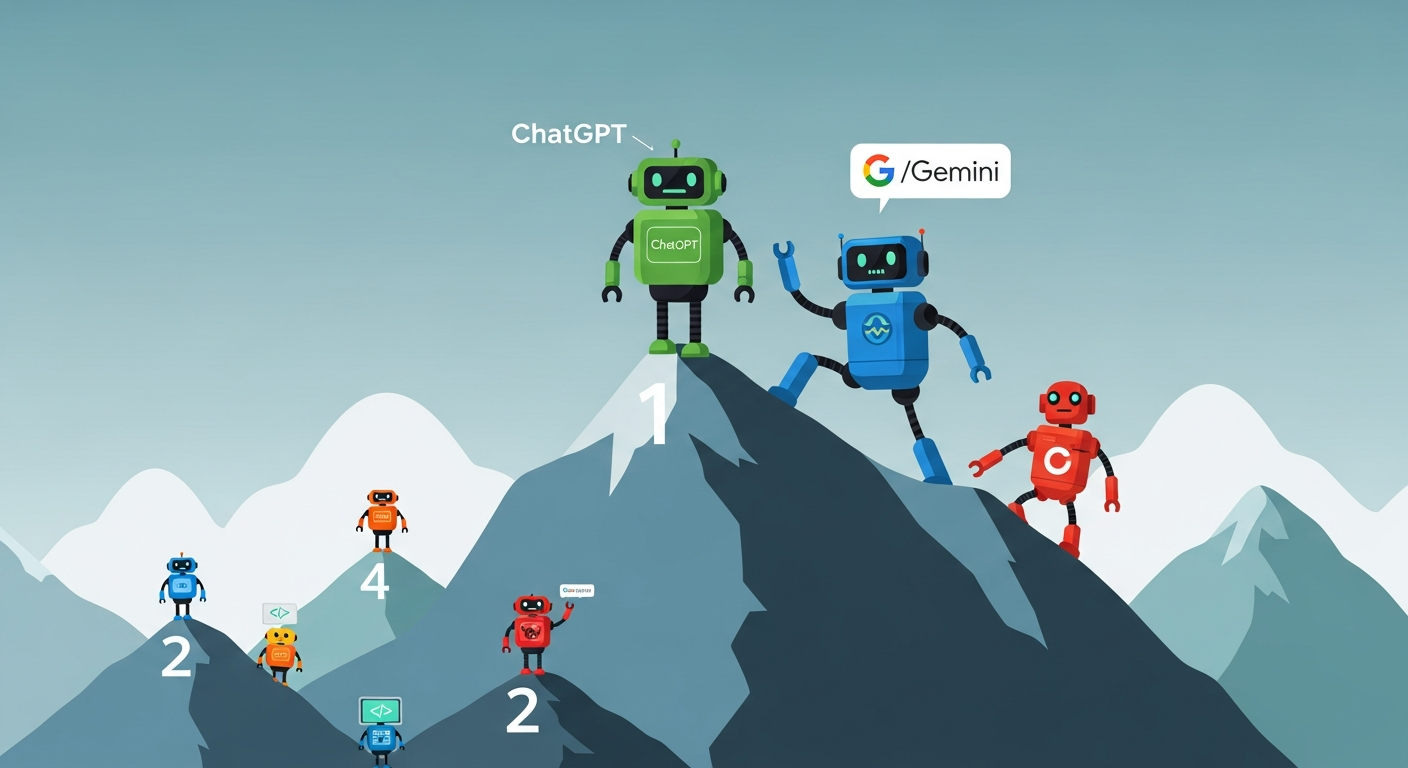

Andreessen Horowitz just dropped their fifth annual ranking of the top 100 AI consumer apps, and the results show the Wild West days are officially over.

Only 11 new apps cracked the web rankings this time, compared to 17 newcomers last edition, suggesting the AI ecosystem is finally stabilizing.

Google made a massive play with four products hitting the top 100 for the first time.

Gemini landed at number two behind ChatGPT, capturing about 12 percent of ChatGPT's web traffic, while their AI Studio, NotebookLM, and Google Labs all secured spots in the rankings.

The vibe coding revolution is getting real traction.

Lovable jumped from the "almost made it" list straight to number 22, while Cursor, Replit, and other AI-powered development tools are seeing triple-digit growth as developers embrace prompt-to-app workflows.

OpenAI and Anthropic just did something unprecedented - they conducted joint safety evaluations of each other's models.

This cross-company collaboration tested for risky behaviors like misuse and self-preservation, marking a significant shift toward industry-wide safety accountability.

NVIDIA posted another monster quarter with dollar 46.7 billion in revenue, up 56 percent year-over-year, with CEO Jensen Huang casually mentioning they expect dollar 3-4 trillion in AI infrastructure spending by 2030.

Meanwhile, ByteDance is reportedly eyeing a dollar 330 billion valuation in their latest employee buyback program.

Google's new "nano-banana" image generation model is generating serious buzz among creators, offering what many are calling the best image generation quality available today while being faster and cheaper than competitors.

DEEP DIVE ANALYSIS

Let's dive deep into that Andreessen Horowitz AI app ranking, because this isn't just a tech leaderboard - it's a crystal ball showing us exactly where the AI industry is heading and what it means for every technology executive listening today.

Technical Deep Dive

What makes this ranking particularly valuable is that it's based on actual usage data from SimilarWeb and Sensor Tower, not just hype or funding announcements. We're seeing real user behavior patterns emerge across 100 AI-native applications. The technical story here is fascinating - the stabilization of the ecosystem with only 11 new web entrants suggests we've moved beyond the experimental phase into genuine product-market fit territory.

The rise of vibe coding platforms like Lovable, which jumped to number 22 and hit dollar 100 million ARR, represents a fundamental shift in software development. These platforms use large language models to generate entire applications from natural language prompts, essentially democratizing software creation. The technical architecture involves sophisticated code generation models, real-time compilation, and deployment pipelines that can turn ideas into functioning web applications in minutes rather than months.

Google's four-product strategy is technically brilliant. By separating Gemini, AI Studio, NotebookLM, and Google Labs into distinct platforms, they're creating specialized user experiences while leveraging the same underlying model infrastructure. This modular approach allows them to capture different use cases - from consumer chat to developer tooling to experimental features - without cannibalizing each other.

Financial Analysis

The financial implications here are staggering. Lovable's jump to dollar 100 million ARR represents the fastest path to nine-figure revenue we've seen in the AI space. But here's what's really interesting - these vibe coding platforms are showing 100 percent revenue retention in their first three months.

That's unprecedented for consumer-facing tools and suggests we're looking at genuinely sticky, valuable products. Google's multi-product approach is a defensive financial strategy. By capturing 12 percent of ChatGPT's web traffic with Gemini alone, they're clawing back search market share that was at risk.

More importantly, they're creating multiple revenue streams from the same AI investment. AI Studio targets developers who'll pay for API access, NotebookLM appeals to knowledge workers who might upgrade to premium features, and Google Labs serves as a testing ground for future monetization. The cost dynamics are shifting too.

As these platforms mature, we're seeing economies of scale kick in. Google's ability to offer competitive pricing while maintaining quality suggests their infrastructure investments are paying dividends. For startups in this space, the message is clear - you need either exceptional differentiation or significant funding to compete on infrastructure costs.

Market Disruption

We're witnessing the emergence of distinct AI application categories. General assistants like ChatGPT and Gemini are becoming the foundation layer, while specialized tools are capturing specific workflows. The vibe coding category didn't exist two years ago, and now it's generating hundreds of millions in revenue.

This pattern suggests we're still in the early stages of AI application differentiation. The competitive landscape is becoming a three-tier system. Tier one is the foundation model providers - OpenAI, Google, Anthropic.

Tier two is the specialized application layer we're seeing in these rankings. Tier three, which is just emerging, will be the industry-specific solutions built on top of these platforms. Traditional software companies should be particularly concerned about the vibe coding trend.

If businesses can generate custom applications through natural language prompts, the entire custom software development industry faces disruption. We're talking about potentially eliminating months-long development cycles for many common business applications.

Cultural and Social Impact

The stabilization of this ecosystem signals we've crossed the chasm from early adopters to mainstream users. When only 11 new apps make the top 100, it means users are developing preferences and loyalty patterns. This is the moment when AI tools transition from novelty to necessity in workplace workflows.

The rise of vibe coding has profound implications for the developer job market. Rather than replacing developers, these tools are creating a new category of "prompt engineers" who can architect complex applications through natural language. This democratization of software creation could lead to an explosion of niche applications that were previously too expensive to develop.

Google's success in this ranking also represents a cultural shift in how we think about AI interaction. Their multi-modal approach through platforms like NotebookLM and AI Studio suggests users want specialized AI experiences, not just general chatbots. This specialization trend will likely accelerate across all industries.

Executive Action Plan

First, technology leaders need to immediately audit their development workflows and identify candidates for vibe coding automation. Don't wait for perfect solutions - start experimenting with platforms like Lovable, Cursor, and Replit on non-critical projects. The companies that learn these workflows first will have a significant competitive advantage as the tools mature.

Set up pilot programs with your development teams and measure productivity gains on small projects. Second, if you're not already experimenting with specialized AI tools in your organization, you're falling behind. The data shows users prefer specialized AI applications over general-purpose chatbots for specific workflows.

Identify the top three time-consuming processes in your organization and find AI-native tools to address them. Don't try to build everything in-house - leverage the specialized platforms that are already gaining traction. Third, prepare for the infrastructure cost implications of AI adoption at scale.

Google's ability to offer competitive pricing while maintaining quality suggests significant infrastructure advantages. If you're building AI features into your products, now is the time to negotiate enterprise deals with cloud providers and model providers. The companies that secure favorable infrastructure terms now will have pricing advantages as the market continues to mature.

Never Miss an Episode

Subscribe on your favorite podcast platform to get daily AI news and weekly strategic analysis.